What to Expect From Tyler Technologies' Q1 2025 Earnings Report

/Tyler%20Technologies%2C%20Inc_%20logo%20on%20phone%20-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $22.5 billion, Tyler Technologies, Inc. (TYL) provides integrated software and technology solutions for the public sector across two segments: Enterprise Software and Platform Technologies. It offers cloud and on-premise solutions for financial management, public safety, courts, property appraisal and tax, K-12 education, regulatory management, cybersecurity, and data insights, with a cloud partnership with Amazon Web Services.

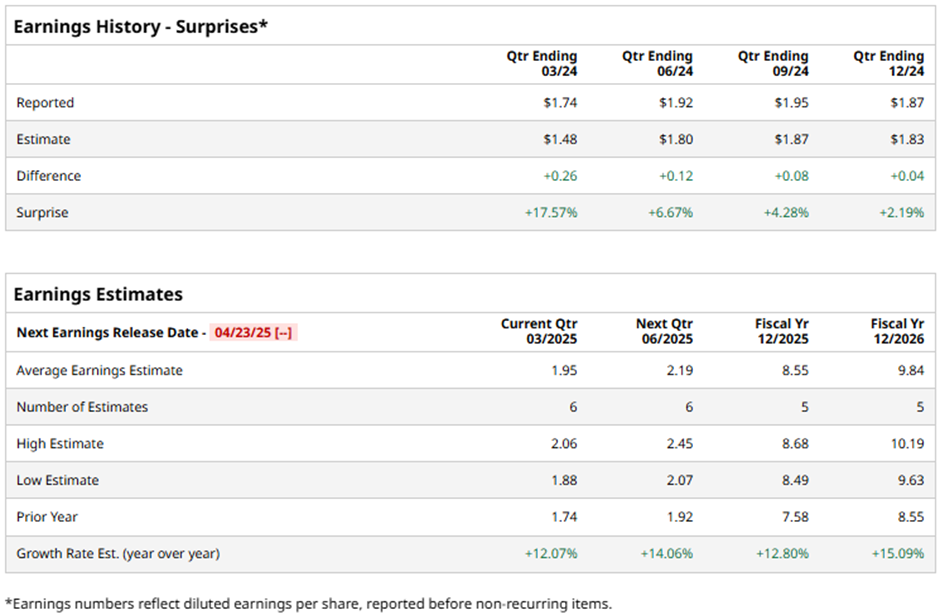

The Plano, Texas-based company is slated to announce its fiscal Q1 2025 earnings results on Wednesday, Apr. 23. Ahead of this event, analysts expect TYL to report a profit of $1.95 per share, a 12.1% growth from $1.74 per share in the year-ago quarter. TYL has exceeded Wall Street's earnings expectations in the past four quarters. In Q4 2024, TYL beat the consensus EPS estimate by 2.2%.

For fiscal 2025, analysts expect the information management software provider to report EPS of $8.55, up 12.8% from $7.58 in fiscal 2024. Moreover, EPS is anticipated to grow 15.1% year-over-year to $9.84 in fiscal 2026.

Shares of Tyler Technologies have gained 23.4% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 4.5% decline and the Technology Select Sector SPDR Fund's (XLK) 12.7% dip over the same period.

Shares of Tyler Technologies climbed over 5.9% following its Q4 2024 earnings release on Feb. 12, driven by revenue of $541.1 million and a 28.6% year-over-year jump in adjusted EPS to $2.43. Investors were also encouraged by a 23.0% increase in SaaS revenues, a 14.9% rise in recurring revenue to $463.9 million, and a 60.7% surge in free cash flow to $216.0 million. Strong operational efficiencies and successful execution of the cloud-first strategy boosted confidence. Management’s 2025 guidance for total revenue and adjusted EPS of $10.90 - $11.15 further fueled optimism.

Analysts' consensus view on Tyler Technologies stock remains bullish, with a "Strong Buy" rating overall. Out of 17 analysts covering the stock, 12 recommend a "Strong Buy," one "Moderate Buys," and four "Holds." As of writing, TYL is trading below the average analyst price target of $708.12.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.