Hogs look cheap compared to cattle

Could Americans turn to pork as a substitute for high-priced beef products? Tyson Foods reports that although shoppers are beginning to turn away from high-priced beef, it hasn't yet resulted in an increase in demand for pork. In addition, President Trump's trade policies could raise prices even more and further dampen the demand for expensive beef products.

In my opinion, if you fully understand selling options, an option strategy to consider for lean hogs is to sell two June lean hog 95 puts, which closed at 1.15 (approximately $4.60) on May 6. Then take that premium that you bring into your account and buy one July lean hog 1.03 call. These options closed at 1.77 (approximately $7.08) on May 6. You will be paid a credit to put this strategy into play. If you don't understand selling options, do not consider this strategy.

If you are interested in learning more about the markets, please use this link to join our email list: SIGN UP NOW

Managed money traders have added 28,000 net longs lean hogs during the last two weeks. The total net long was 67,643 contracts on April 29, according to the Commodity Futures Trading Commission Commitments of Traders report. Managed money traders have been re-entering the cattle market and it has been working as cattle markets trends to new contract highs.

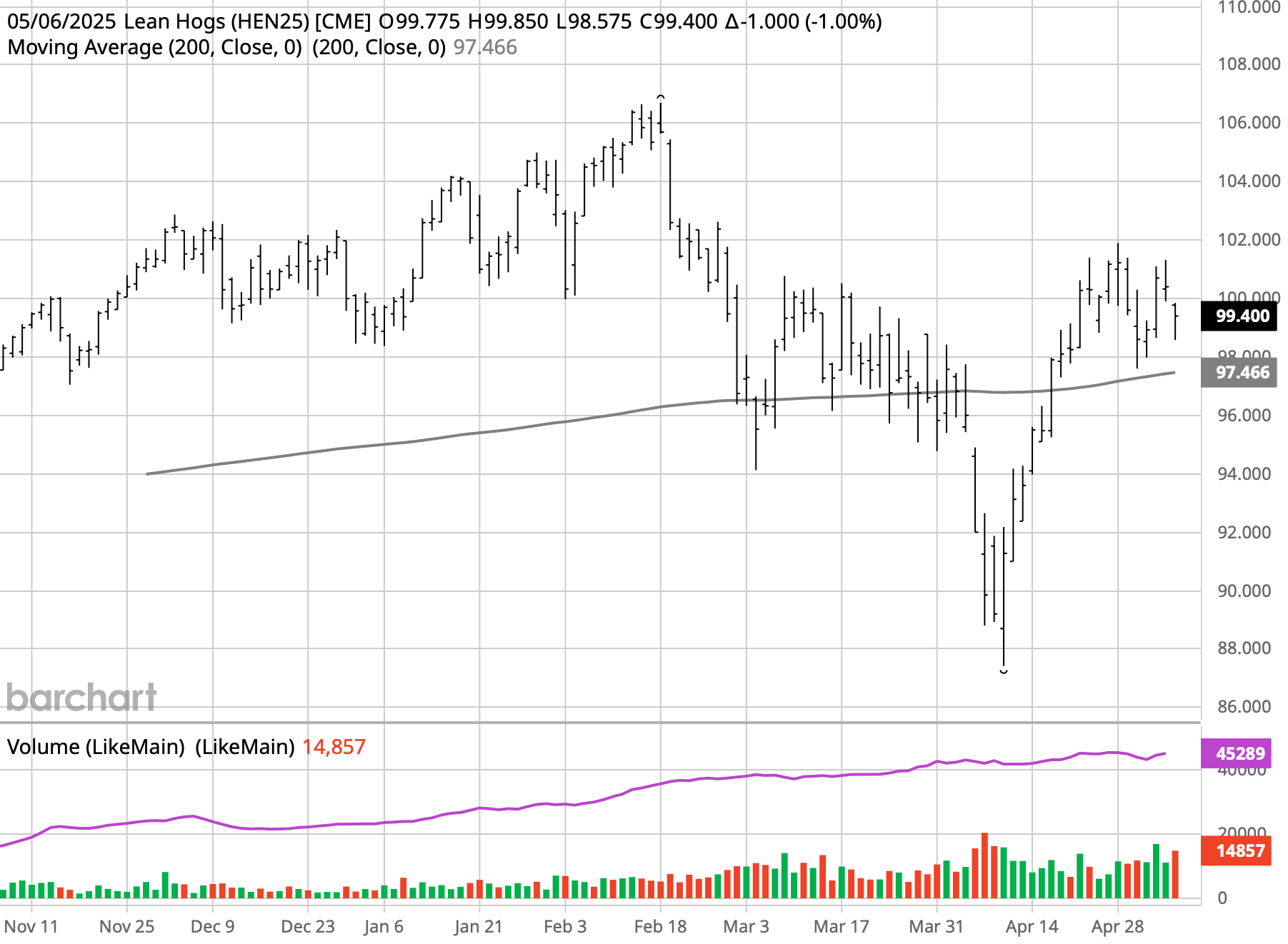

I think managed money traders are going to continue to buy lean hogs in addition to live cattle. Last week's retreat was relatively slight in lean hogs and if the market can move above last week's high of 101.97 and run up to 105.17, that could fill gap from last February. June lean hog prices need to hold to 96.80 to maintain the bullish direction.

These charts show a lot of positive action above the 200-day moving average. The margin for lean hogs is 1850.00 so you need $5,000-10,000 in your account to execute this strategy. If June lean hogs go under 95, buy the puts back that you sold and take your loss. The expiration date on June lean hog options is June 13. For July, the expiration date on July lean hog options is July 15. Let's look for a summer rally in hogs.

If you have questions about this strategy, please contact me.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878-2391 8248

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join our email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.