As QuantumScape Hits New 2025 Highs, Should You Buy, Sell, or Hold QS Stock?

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

QuantumScape (QS) is back in focus on Wall Streetafter a scorching run-up in which its shares have reached new 52-week highs. The pioneer of solid-state batteries is up roughly 45% just five trading days, thanks to excitement over its latest production announcement.

This wave of interest in QS emerges at a critical time for the electric vehicle industry, which needs better, safer battery tech. Solid-state cells will yield longer ranges, rapid recharge ability, and higher inherent safety levels, and QuantumScape is aspiring to deliver these cutting-edge batteries. Its latest Cobra separator breakthrough has renewed investor confidence that QS could truly be an industry disruptor.

About QuantumScape Stock

QuantumScape (QS) is a next-generation developer of solid-state lithium-metal batteries for the electric vehicle industry. Although its market capitalization is approximately $6.3 billion, QuantumScape does not have any commercial revenue. However, the company is consistently positioning itself as a future market leader based on its innovation leadership as well as partners. QuantumScape’s agreement with Volkswagen’s (VWAGY) PowerCo battery arm is evidence of its ambitions of scaling up production.

QS stock has given investors a rollercoaster ride. Shares have surged from a 52-week low of $3.40 to a new high of $13.61 in 2025, good for a gain of over 152% in the year to date. That performance blows away the roughly 7% year-to-date appreciation of the S&P 500 Index ($SPX).

QuantumScape Reports Loss as Expected but Shows Cobra Progress

QuantumScape’s quarterly results were in line with expectations for a pre-revenue deep-tech developer. It recorded a net loss of $114.4 million in Q1 2025 with an adjusted EBITDA loss of $64.6 million, within its full-year adjusted EBITDA loss targets of $250 million to $280 million. This comes as it increases spending in efforts of establishing next-generation cell production lines.

Among the biggest positives was QuantumScape’s announcement of its Cobra separator process breakthrough. It offers a 25-time production rate increase over its previous system with significantly reduced equipment footprint. The company confirmed that Cobra is already in base production ahead of schedule and that it will have greater levels of its QSE-5 battery cells entering the company’s current launch program with Volkswagen’s PowerCo.

Management also reiterated its healthy cash situation, ending Q1 with $860 million in liquidity and once again stating that its cash runway extends well into the second half of 2028. The roadmap includes scaling up customer sample shipments, expanding collaboration agreements with suppliers like Murata Manufacturing (MRAAY), as well as field testing of QSE-5 modules in 2026, all notable milestones as QuantumScape works toward proving its solid-state platform at commercial scale.

What Do Analysts Expect for QuantumScape Stock?

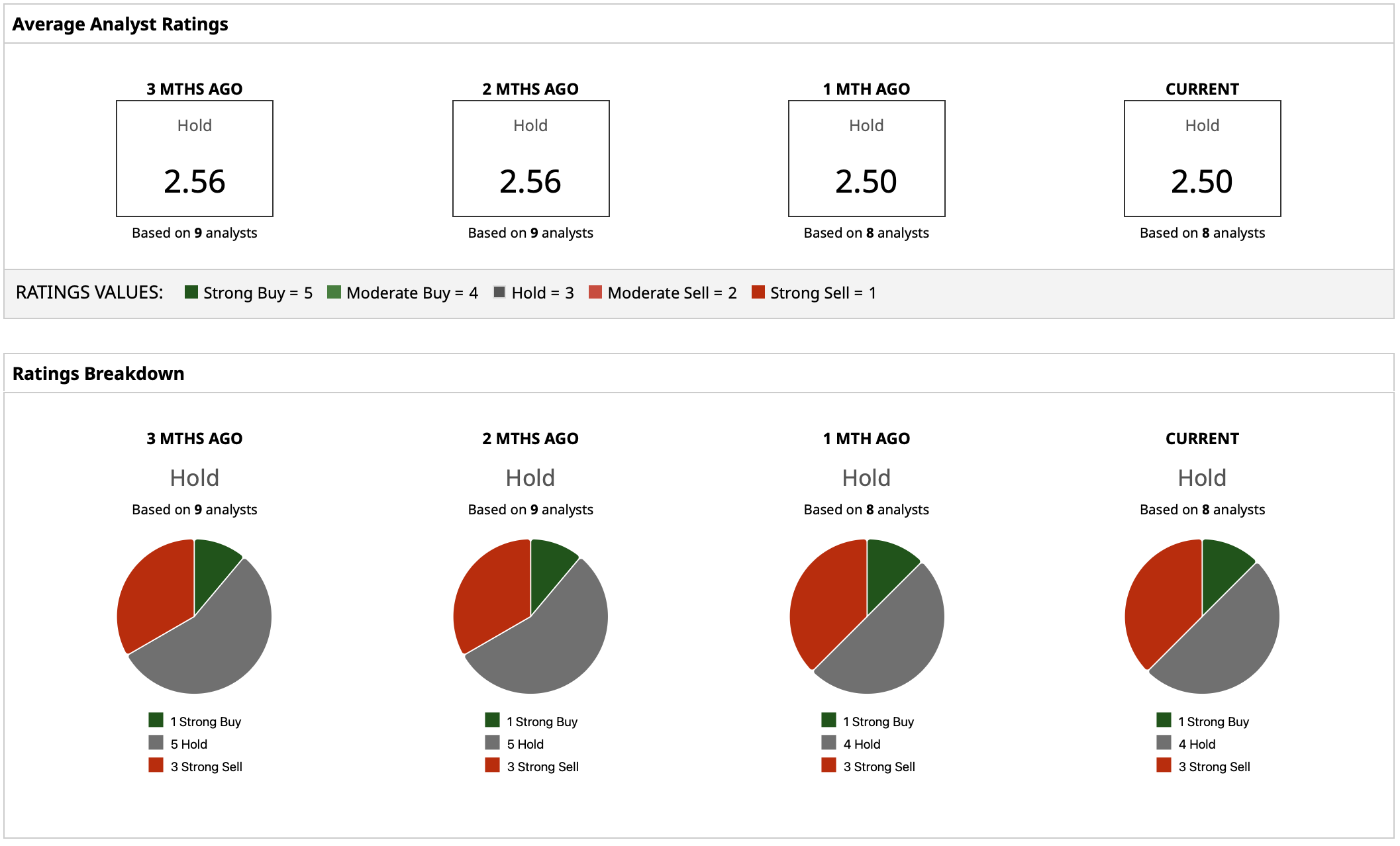

Wall Street remains divided on whether QS shares are worth the hype.

QuantumScape has a consensus “Hold” rating among analysts. The average price target of the company is $4.79, way lower than its current price of over $13, due to investor concerns on sustained losses, capital needs, and the risk of commercialization and scaling delays.

Shares are also trading significantly above the Street-high price target of $8. It seems Wall Street is waiting for QuantumScape to deliver more meat, such as through a meaningful commercial order or a more significant production update.

Right now, the risks simply outweigh the rewards.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.