Dear Target Stock Fans, Mark Your Calendars for August 20

Target’s (TGT) transformation from a reliable investment candidate to a struggling retailer tells the story of today’s consumer squeeze. The retailer’s shares have taken a heavy beating this year, and it’s not hard to see why. While retail giants like Walmart (WMT) and Costco (COST) continue to benefit from essential goods, Target built its empire on trendy-yet-affordable discretionary merchandise, exactly what consumers are cutting when money gets tight.

Mounting inflation concerns, potential tariff impacts, and overall economic uncertainty have pushed shoppers to prioritize necessities over Target’s signature offerings. The retailer is watching its sales in its key discretionary categories, such as home decor, struggle as customers become increasingly selective with their spending.

As a result of having a higher percentage of discretionary merchandise than its peers, Target is losing market share to rivals like Walmart and Costco, which have proven more resilient during economic uncertainties due to their greater focus on everyday necessities. So, amid this ongoing decline in consumer confidence, here’s a fresh look at the retail giant as it gears up to lift the curtains on its second-quarter earnings on Aug. 20.

About Target Stock

Minneapolis-based Target is a leading general merchandise retailer offering a wide range of products and services across various categories, including apparel, home goods, electronics, beauty, groceries, and everyday essentials. Beyond products, Target emphasizes convenience through services such as the Target app, Target Circle loyalty program, same-day delivery with Shipt, order pickup, drive-up, and free 2-day shipping.

With 1,981 stores nationwide, supported by 66 supply chain facilities and 29 global office locations, Target employs over 400,000 team members who drive its operations and guest experience. Notably, more than 75% of the U.S. population lives within 10 miles of a Target store, underscoring its strong community presence and accessibility. But despite its strong presence, the company has been struggling.

In addition to macroeconomic challenges weighing on consumer sentiment, Target’s stock also faced pressure earlier this year after the retailer dialed back its diversity, equity, and inclusion (DEI) programs. While other companies have taken similar steps in the wake of President Donald Trump’s reelection, Target’s reversal drew sharper backlash given its reputation as an early leader in such initiatives.

The move has alienated some of its core shoppers, adding to the headwinds facing the stock. The company’s market capitalization presently stands at about $47.7 billion. So far this year, shares of the retail giant have declined a notable 21.6%, significantly underperforming the broader S&P 500 Index ($SPX), which is up a modest 9.3% on a year-to-date (YTD) basis.

After months of lackluster trading, Target’s stock is starting to look like a bargain opportunity. Shares currently trade at just 13.78 times forward earnings and 0.44 times sales, which is well below the sector medians of 16.58 times and 1.19 times, respectively. In addition to its compelling valuation, Target continues to stand tall as a reliable income play.

With a remarkable 54 consecutive years of dividend growth, the retailer holds the elite status of a Dividend King. In June, the company lifted its payout once again, up 1.8% to $1.14 per share, payable on Sept. 1, underscoring its commitment to shareholders even as the business navigates headwinds. On a forward basis, the annual dividend of $4.56 per share translates to a generous yield of 4.3%. And with Target remaining solidly profitable even amid its recent struggles, its dividend looks well-covered.

Target’s Q1 Earnings Snapshot

Target opened fiscal 2025 on a challenging note, with first-quarter results released on May 21 underscoring the strain on consumer spending. Net sales slipped 2.8% year-over-year (YOY) to $23.8 billion, falling short of Wall Street’s $24.4 billion forecast. Comparable sales declined 3.8%, dragged by a 5.7% drop in store traffic, though digital sales stood out with a 4.7% gain, powered by a robust 36% surge in same-day services such as Drive Up and Target Circle 360.

Earnings told a mixed story. GAAP EPS rose to $2.27 from $2.03 a year earlier, boosted by a $593 million legal settlement tied to credit card interchange fees. However, stripping out that one-time gain, adjusted EPS fell to $1.30, well below last year’s $2.03 and missing analyst expectations by nearly 20%.

Category trends highlighted consumer caution, with sales falling across most discretionary areas, while Food and Beverage edged slightly higher to $5.9 billion.

Even so, the retail giant stayed true to its shareholder-friendly stance, returning capital through an impressive $510 million in dividends and $251 million in share buybacks during the quarter, demonstrating a commitment to investors despite a challenging backdrop.

Target Investors, Mark Your Calendars for August 20

Target’s soft first-quarter results underscored the retailer’s ongoing struggle to reignite growth and reclaim its once-iconic “cheap chic” appeal. CEO Brian Cornell acknowledged that while the company’s fundamentals remain sound, management isn’t content with the current pace of progress. To speed things up, Cornell unveiled the creation of a new multi-year Enterprise Acceleration Office, to be led by Chief Operating Officer Michael Fiddelke, along with several leadership changes aimed at boosting execution.

According to Cornell, these moves are designed to bring more speed and agility into Target’s operations while sharpening its core capabilities to fuel long-term, profitable growth. Still, the near-term outlook has dimmed. The company now projects a low-single-digit sales decline for the current fiscal year, a reversal from its earlier forecast of roughly 1% growth. On the earnings front, Target expects adjusted EPS, excluding litigation settlement gains, to land between $7 and $9 for the year, down from its prior range of $8.80 to $9.80.

The company is scheduled to release its second-quarter earnings report before the market opens on Wednesday, Aug. 20, and Wall Street isn’t expecting much cheer. Analysts project the retailer’s bottom line to fall 19.8% YOY, with EPS estimated at $2.09. Apart from giving insights about its financial health, the upcoming results will also serve as a gauge for broader retail sector resilience.

Target’s upcoming report is expected to offer a window into changing consumer behavior, its ability to manage inventory efficiently, and how well it’s holding onto pricing power in the face of inflation and labor market pressures. More importantly, the report will act as a pulse check on discretionary spending and the financial health of middle-income consumers, key drivers of Target’s growth story.

What Do Analysts Think About Target Stock?

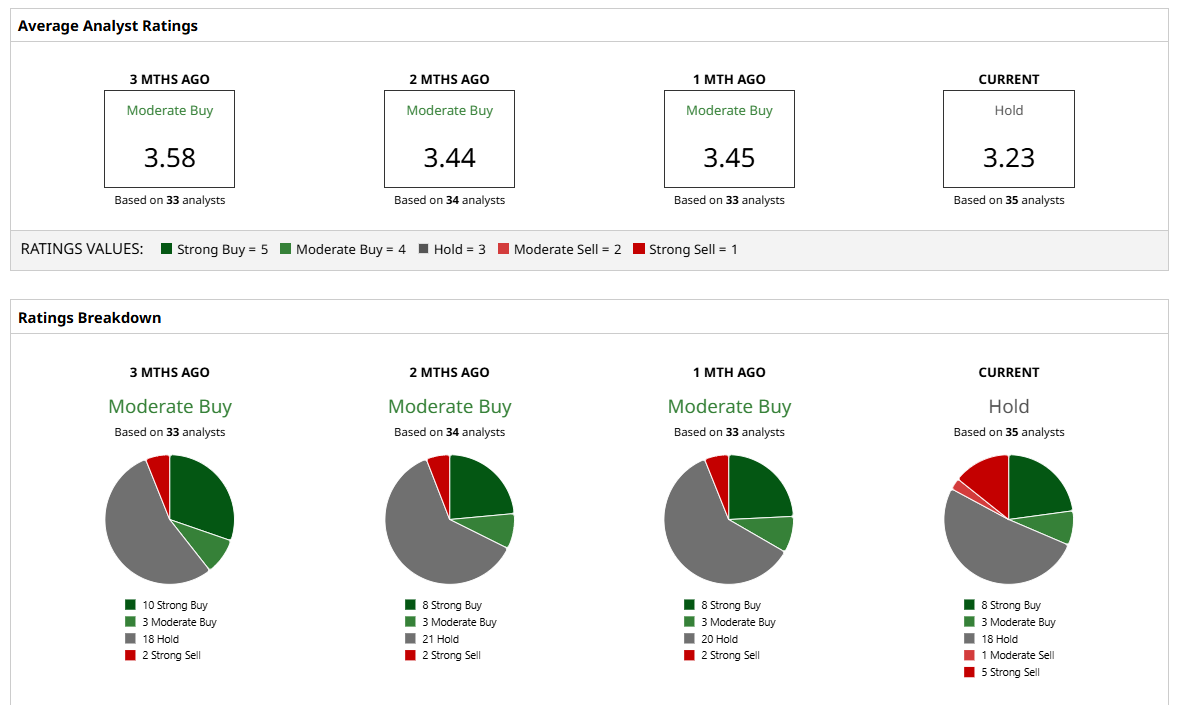

With second-quarter earnings approaching, Wall Street appears cautious on TGT stock, maintaining a consensus “Hold” rating overall. Among 35 analysts, only eight are backing the stock with a “Strong Buy” and three with a “Moderate Buy,” while a majority of 18 analysts sit on the sidelines with a “Hold.” On the bearish side, one analyst recommends a “Moderate Sell,” while five go further with a “Strong Sell,” underscoring the uncertainty ahead of the report.

TGT’s average analyst price target of $108.10 signals only 3% potential upside from current levels, while the Street-high target of $135 indicates that the stock can rally as much as 28% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.