Are Wall Street Analysts Predicting Wynn Resorts Stock Will Climb or Sink?

/Wynn%20Resorts%20Ltd_%20%20vegas%20hotel%20by-%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $11.7 billion, Wynn Resorts, Limited (WYNN) is a premier developer, owner, and operator of luxury integrated resorts with properties in Las Vegas, Macau, and Boston. Renowned for its world-class hospitality and entertainment, the company holds more Forbes Travel Guide Five-Star awards than any other independent hotel company.

Shares of the Las Vegas, Nevada-based company have surpassed the broader market over the past 52 weeks. WYNN stock has returned 47.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. Moreover, shares of the company are up 31% on a YTD basis, compared to SPX’s 9% gain.

Focusing more closely, the casino operator stock has also outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) nearly 24% increase over the past 52 weeks.

Shares of Wynn Resorts fell marginally following its Q2 2025 results on Aug. 7 as the company reported weaker-than-expected adjusted EPS of $1.09. The weakness was driven by its Macau operations, where adjusted property operating profit declined 9.5% to $253 million, hurt by softer VIP hold.

For the fiscal year ending in December 2025, analysts expect WYNN’s EPS to decline 23.3% year-over-year to $4.62. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

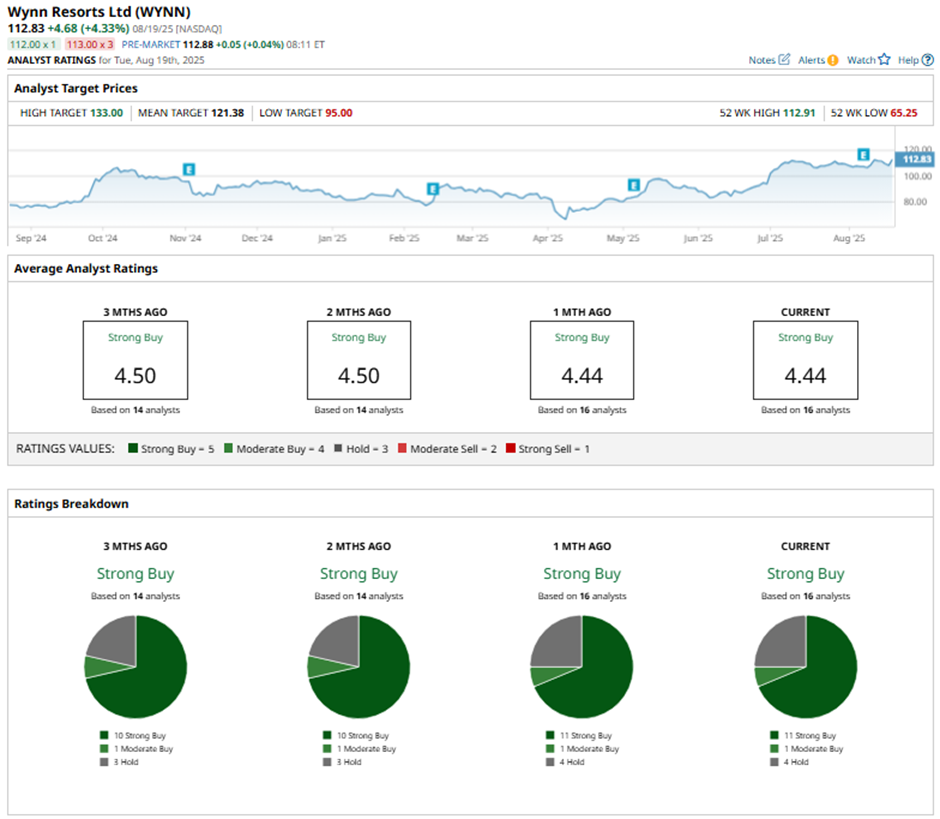

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

This configuration is slightly more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 9, Barclays analyst Brandt Montour reiterated a “Buy” rating on Wynn Resorts with a price target of $127.

As of writing, the stock is trading below the mean price target of $121.38. The Street-high price target of $133 implies a potential upside of 17.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.