As Trump Talks Intel Stake, Billionaires Can’t Get Enough of INTC Stock

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

In late summer 2025, Intel’s long-slumbering stock sprang to life as Washington’s political winds shifted. President Trump, who had once criticized Intel (INTC), suddenly signaled support. The U.S. announced plans to convert unused CHIPS Act grants into a roughly 10% equity stake in Intel.

At the same time, marquee investors piled into INTC stock. Billionaire David Tepper’s Appaloosa Management disclosed an 8 million share position worth around $179 million in Q2, and others followed suit: AQR Capital boosted its holding by 210%, Citadel added 6.25 million shares, and Renaissance Technologies bought 7.22 million shares of Intel. Even SoftBank (SFTBY) announced a $2 billion investment at roughly $23 per share in mid-August. All told, Wall Street’s smartest money seems to be treating Intel as a potential comeback story, a beaten-down chip giant suddenly viewed as a turnaround play. Could it be? Let's discuss.

About INTC Stock

Based in California, Intel is a legacy chipmaker at the center of a high-stakes turnaround. Once dominant in PCs and data centers, the company now fights to reclaim ground lost to AMD (AMD), Nvidia (NVDA), and TSMC (TSM). With fresh investments, government backing, and renewed investor interest, Intel is positioning itself as a rebound value play.

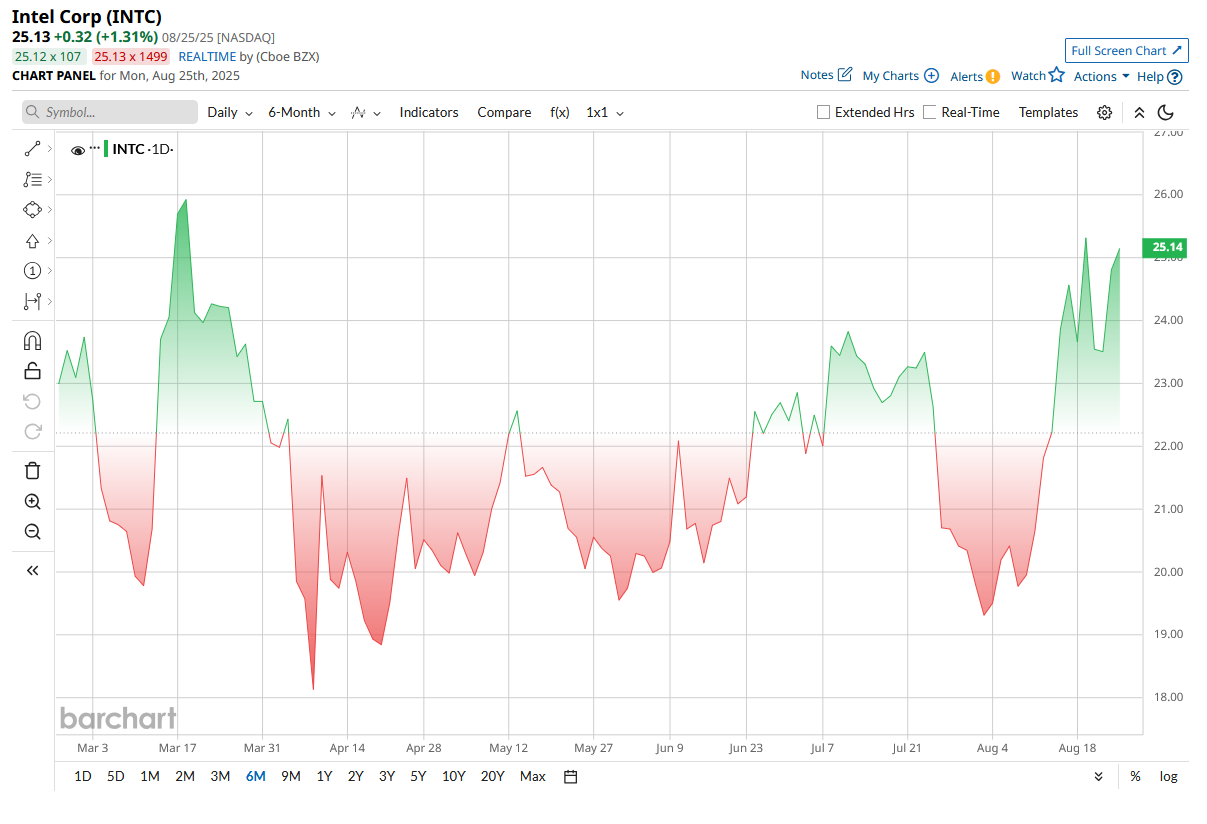

After a bumpy start to 2025, Intel’s stock has staged a strong rebound, climbing 20% in the past month, bringing its year-to-date gain to 27%. The rally has been fueled by reports of potential government interest in taking a stake, sparking renewed optimism around the chipmaker’s turnaround.

In terms of Valuation, INTC is trading at very attractive multiples. Its price-to-book (P/B) ratio of 1.04x is notably lower than the sector median of 4.45x, implying it is undervalued. Additionally, its price-to-sales (P/S) ratio is 2.02x compared to the sector's 3.30x, suggesting a cheaper price relative to revenue.

Moreover, Intel offers a solid dividend of around $0.28 per share per quarter, making it a contender for value-oriented and dividend-focused investors.

Billionaire & Hedge Fund Bets

Even before the official deal, big investors were acting as if Intel’s bottom had arrived. In Q2, Tepper’s Appaloosa established a new position of 8 million shares in Intel. Other hedge funds also piled in, as mentioned in the intro. In aggregate, I think these moves suggest, as Surbhi Jain writing for Bazinga wrote: “some of Wall Street’s smartest minds see Intel as a major turnaround play.”

This smart-money buying has come alongside a sharp rise in Intel’s stock. Reports indicated the stock jumped more than 20% on news of the government stake and SoftBank’s investment. The combination of political support and hedge-fund accumulation has been cited as key momentum drivers. For retail investors, the message seems clear: if billionaire managers are betting big, maybe this long-suffering chip leader is finally turning the corner.

Intel Shows Mixed Q2 Performance

Despite the political excitement, Intel’s Q2 earnings showed a business still in repair. Revenue was $12.86 billion in Q2 2025, essentially flat year-over-year. The company missed on profitability with an EPS loss of $0.26, missing the estimated $0.14.

Intel took heavy one-time charges, about $1.9 billion of restructuring costs and $800 million of asset write-downs, which weighed on margins and drove the loss. As a result, adjusted operating profit remains negative, and gross margins have compressed. For example, in Q2, the gross margin was only 27-28% compared to the mid-30s a year earlier, as outdated factory equipment was retired.

Intel also burned cash in the quarter, with a loss of $1.1 billion of adjusted free cash flow (FCF), largely due to continued investment and costs. However, the balance sheet still showed roughly $21 billion in cash and short-term investments at quarter-end.

On the other hand, Intel is aggressively trimming expenses. CEO Lip-Bu Tan said Intel has already slashed about 15% of its core workforce. The goal is to limit annual R&D+MG&A spending to $17 billion in 2025, down from over $20 billion, and to cap capital expenditures at $18 billion for the year. CFO David Zinsner emphasized that monetizing non-core assets and lowering operating costs are key to “strengthening our balance sheet.”

Looking at the future, management expects Q3 2025 revenue of roughly $12.6 to $13.6 billion and is targeting EPS of about a loss of $0.24 for the period. This outlook assumes the company’s cost-cutting plans continue to take hold.

What Do Analysts Say About Intel Stock?

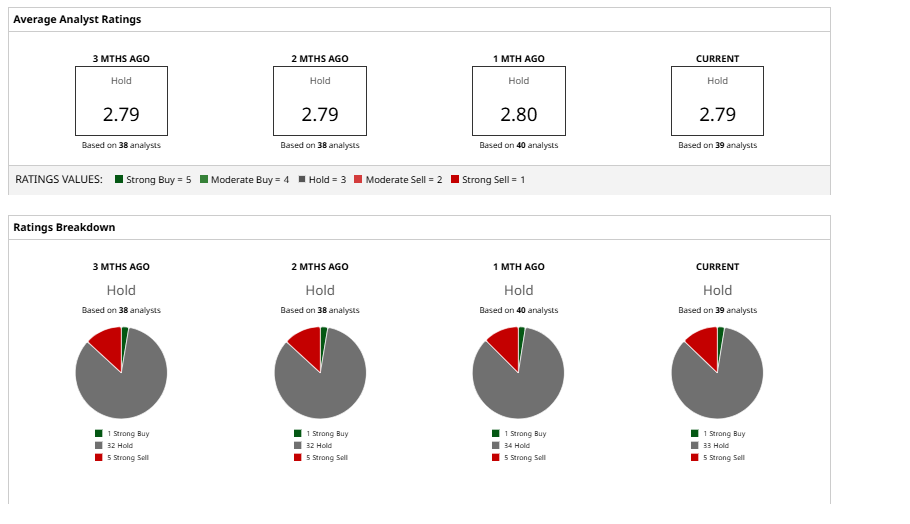

Most analyst firms stayed cautious on Intel’s government stake news. UBS analyst Timothy Arcuri reiterated a “Neutral” stance, noting that limited EPS power at the company level could cap gains near the mid-$20 range.

Of the 39 analysts tracked by Barchart, the consensus rating stands at “Hold,” with a breakdown of one “Strong Buy,” 33 “Hold,” and five “Strong Sell.” Intel shares have already moved past the average price target of $23, though the Street-high forecast of $62 implies a potential 148% upside from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.