2 AI Chip Stocks Poised to Win on Wall Street Next

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

While Nvidia (NVDA) remains the undisputed leader in artificial intelligence (AI) chips, a few other emerging companies are gaining investor attention.

Their trajectory suggests they could be the next major chip stock to ride the AI wave. Furthermore, Wall Street has rated both of these chip stocks as “Strong Buy.” For investors looking beyond the usual suspects, Marvell Technology (MRVL) and Broadcom (AVGO) could be names worth watching closely.

Chip Stock #1: Broadcom

Valued at $1.4 billion, Broadcom is a global technology company that designs and develops semiconductors and infrastructure software. AVGO stock is up 28% year-to-date, while the tech-heavy Nasdaq Composite Index ($NASX) is up 11.6%.

Broadcom operates in two segments. On the semiconductor side, it manufactures products for data centers, AI, networking (Ethernet switches/routers), broadband, wireless, and storage. On the software front, through the VMware acquisition, it provides cloud and virtualization software that enables enterprises to build and manage private and hybrid clouds.

In the second quarter, Broadcom generated total revenue of $15 billion, representing a 20% year-over-year increase. Adjusted EBITDA surged to $10 billion, up 35% from a year ago, reflecting exceptional operating discipline. Adjusted earnings increased by an impressive 43.6% to $1.58 per share, with a gross margin of 79.4% thanks to a favorable product mix. Broadcom’s rapidly expanding AI business generated $8.4 billion in semiconductor revenue, a 17% increase year over year. AI semiconductor revenue alone reached $4.4 billion, a 46% increase, marking the ninth consecutive quarter of double-digit growth. Broadcom’s Ethernet-based networking solutions, such as Tomahawk switches, Jericho routers, and network interface cards, have become essential for hyperscale AI clusters.

Broadcom’s infrastructure software division is powered by VMware and generated $6.6 billion in revenue, a 25% increase. Management announced that 87% of its 10,000 largest customers have now adopted VMware Cloud Foundation (VCF), resulting in a stable and growing base of annual recurring revenue. In the quarter, free cash flow amounted to $6.4 billion, or 43% of revenue. The company ended the quarter with $9.5 billion in cash and $69.4 billion in gross principal debt. Broadcom paid $2.8 billion in dividends and repurchased $4.2 billion in shares in the second quarter.

The company will report its third-quarter earnings on Sept. 4. Broadcom expects Q3 AI semiconductor revenue of $5.1 billion, representing a 60% year-over-year increase and the tenth consecutive quarter of AI-driven expansion. Infrastructure software revenue is expected to grow by 16%, reaching $6.7 billion. Total consolidated revenue is expected to increase by 21% year on year to $15.8 billion.

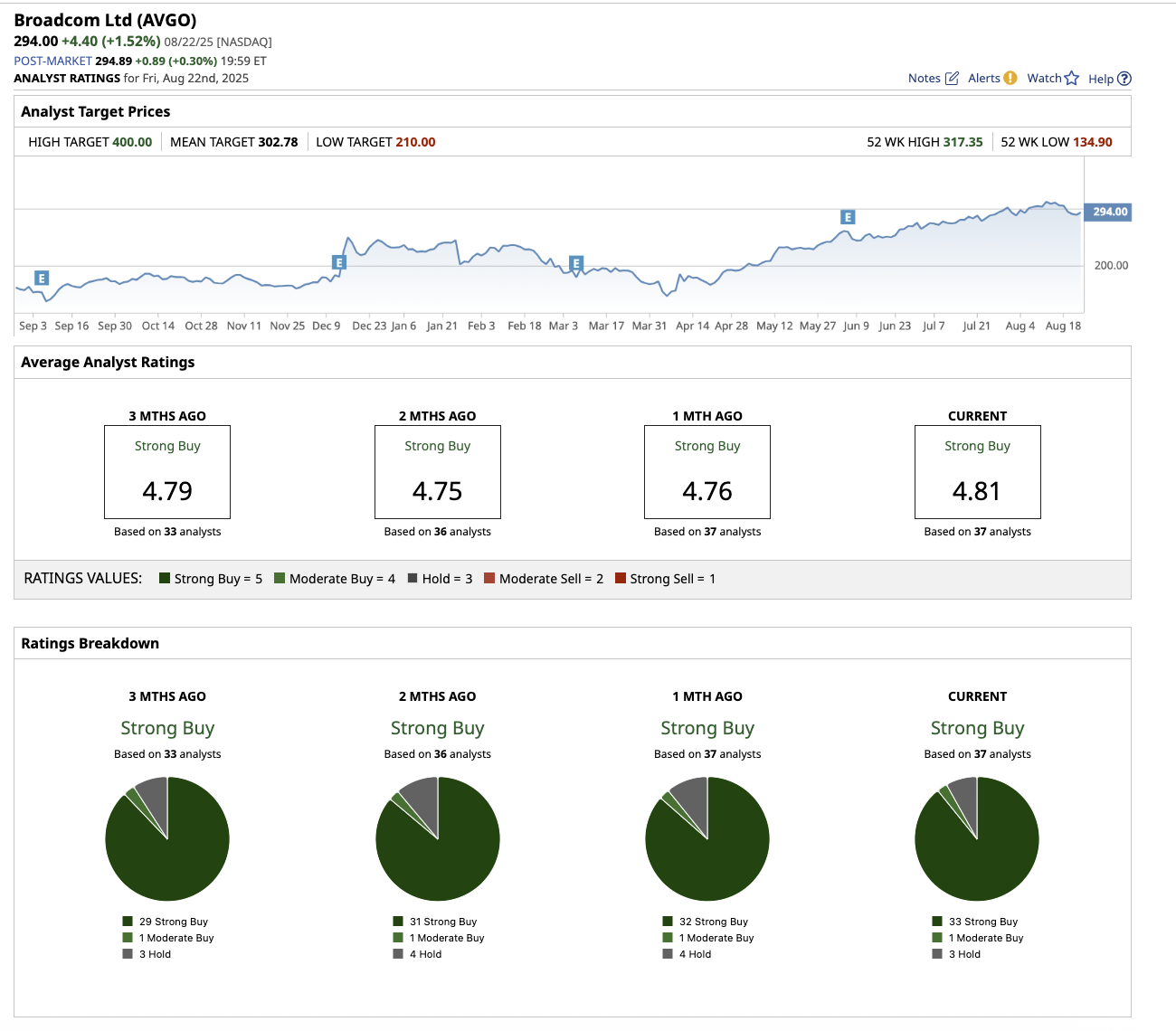

Overall, AVGO stock has garnered a “Strong Buy” rating on the Street. Out of the 37 analysts in coverage, 33 rate it a “Strong Buy,” one says it is a “Moderate Buy,” and three recommend a “Hold.”

Based on the mean target price of $302.78, the stock has potential upside of 3% from current levels. Plus, its high price estimate of $400 indicates the stock could gain as much as 36% in the next 12 months.

Chip Stock #2: Marvell Technology

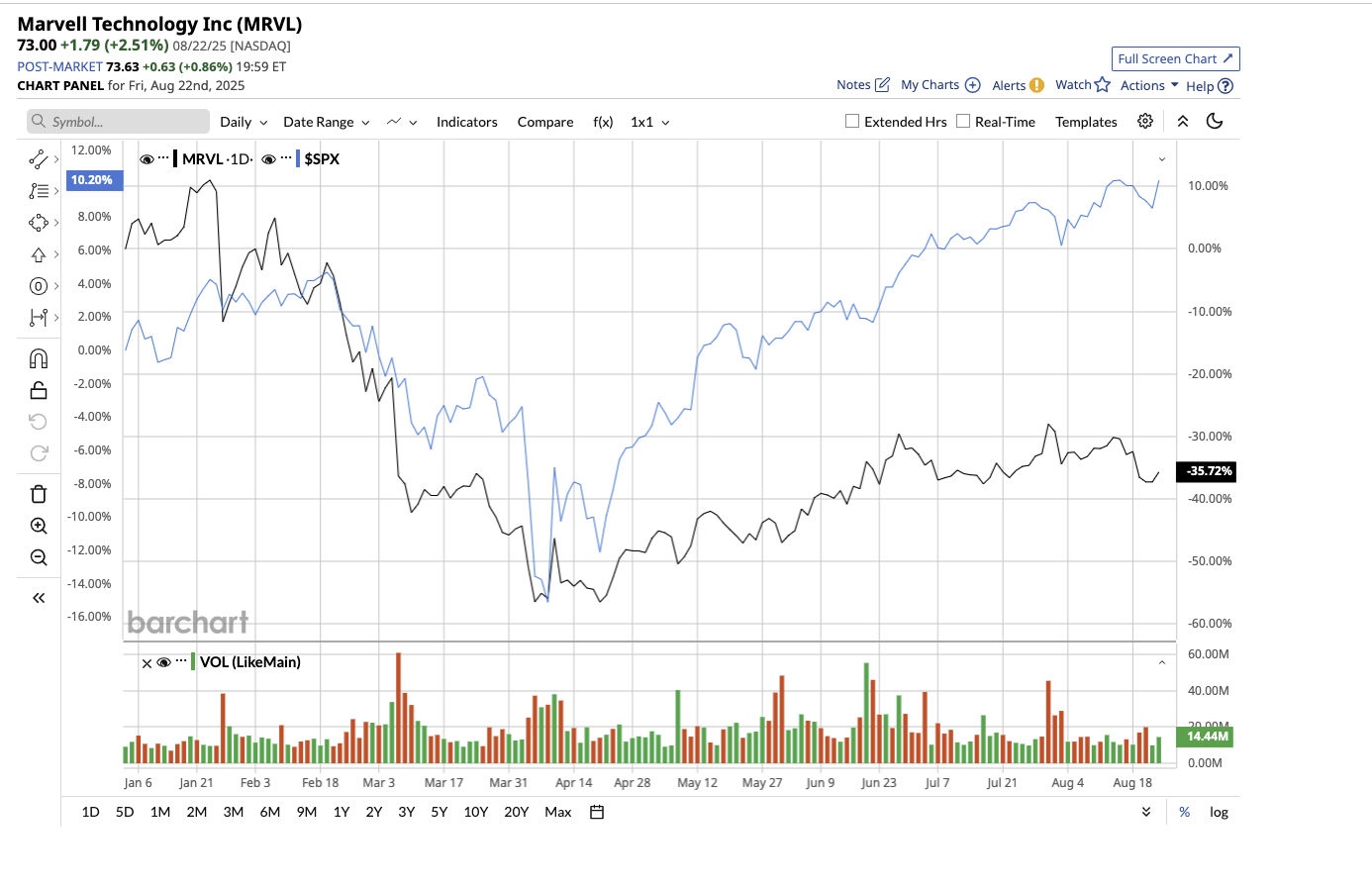

Marvell Technology, valued at $63 billion, is a semiconductor company that does not produce CPUs or GPUs like Intel (INTC) or Nvidia. It creates integrated circuits and chips that power cloud AI computing, high-speed networking, 5G, and automotive systems. Marvell stock has dropped 33% year to date.

The semiconductor maker reported record first-quarter fiscal 2026 revenue of $1.89 billion, up 63% year on year. Fueled by insatiable AI demand and a sharp recovery in networking markets, Marvell not only exceeded its own revenue and earnings targets, but also the consensus estimates. Adjusted earnings per diluted share rose 158% to $0.62. Marvell’s data center segment generated a record $1.44 billion, a 76% increase year on year. This business now accounts for the vast majority of the company’s revenue. Management attributed this growth to the rapid scaling of custom AI silicon programs into high-volume production, as well as consistent shipments of electro-optics products designed for AI and cloud deployments.

In the quarter, Marvell announced the integration of Nvidia’s (NVDA) NVLink Fusion into its custom silicon platform, solidifying its position as a complement to Nvidia’s merchant GPUs. While AI dominates the company’s growth story, Marvell's enterprise networking ($178 million) and carrier infrastructure ($138 million) businesses are also showing signs of improvement.

While focusing on AI, Marvell is also streamlining its portfolio. In the first quarter, the company announced that it had sold its Automotive Ethernet business to Infineon (IFNNY) for $2.5 billion.

The company ended the quarter with $886 million in cash and equivalents and $4.2 billion in total debt. Shareholder returns accelerated as the company paid out $52 million in dividends and repurchased $340 million of stock in Q1.

Marvell will report earnings for the second quarter of fiscal 2026 on Aug. 28. With AI-related sales already accounting for the majority of its data center revenue and expected to grow further, the company has established a strong foundation for long-term growth.

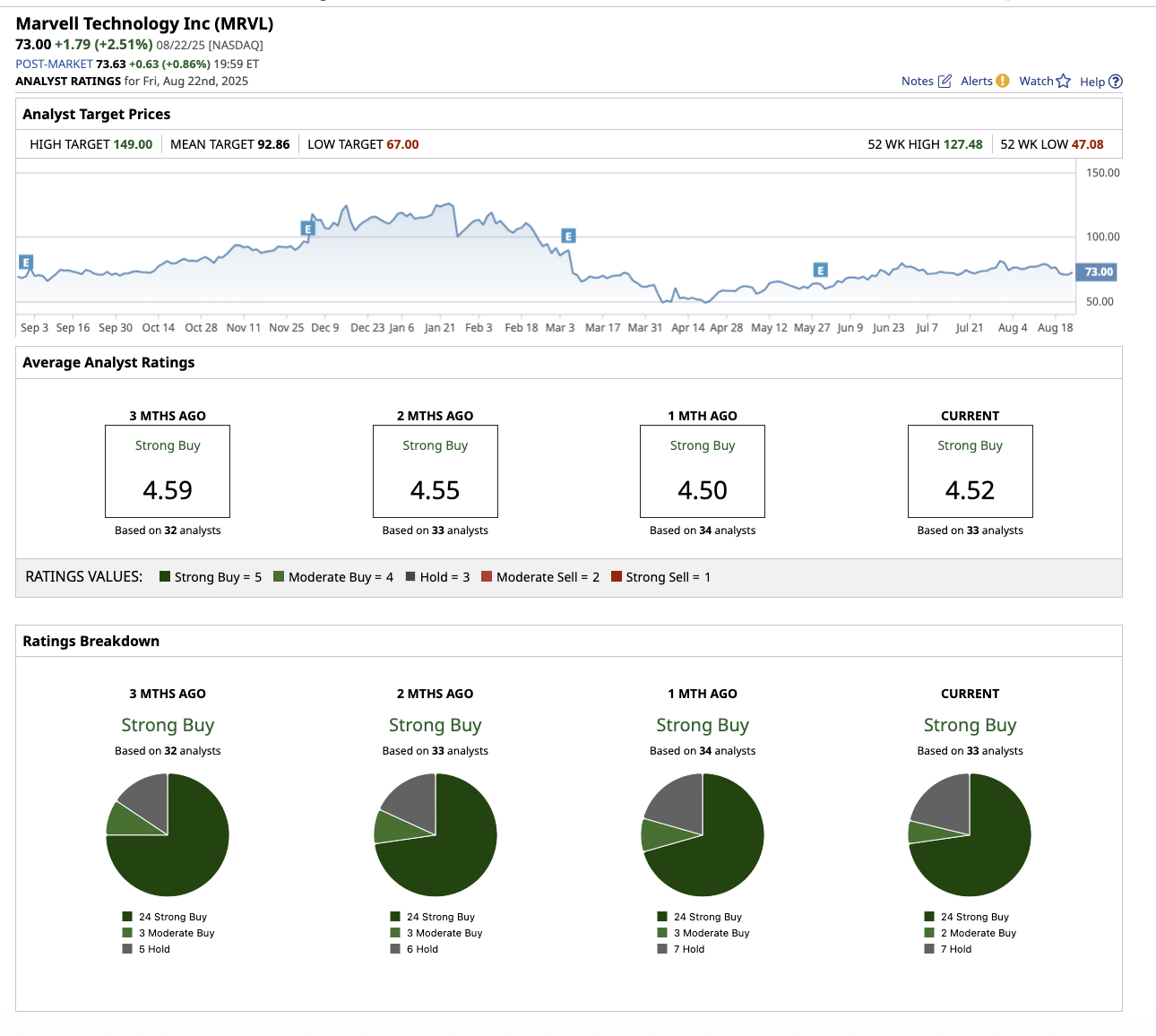

Overall, analysts remain optimistic for Marvell’s future, rating it a “Strong Buy.” Out of the 33 analysts covering MRVL, 24 have rated it a “Strong Buy,” two have a “Moderate Buy” recommendation, and seven suggest a “Hold.” The average price target for MRVL stock is $92.86, which implies potential upside of 27.2% from current levels. Additionally, its high target price of $149 implies potential upside of 104.1% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.