Do Wall Street Analysts Like Align Technology Stock?

/Align%20Technology%2C%20Inc_%20magnified-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

Valued at a market cap of $10.3 billion, Align Technology, Inc. (ALGN) specializes in orthodontic and dental solutions. The company, based in Tempe, Arizona, designs, manufactures, and markets its flagship Invisalign clear aligners, as well as iTero intraoral scanners and related services for orthodontists and general dentists.

ALGN shares have significantly lagged behind the broader market over the past 52 weeks. Align has declined 39.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.2%. Moreover, the stock is down 31.9% on a YTD basis, compared to SPX’s 10.2% gain during the same time frame.

Zooming in further, ALGN has also trailed the Health Care Select Sector SPDR Fund’s (XLV) 12% decline over the past 52 weeks and has dipped marginally on a YTD basis.

On Aug. 5, ALGN shares soared 1.4% after the company announced plans to repurchase $200 million of its common stock through open-market transactions under its $1 billion stock buyback program approved in April 2025. CFO John Morici said the move reflects confidence in the company’s long-term strategy, strong balance sheet, and cash flow, emphasizing disciplined investment and a focus on sustainable growth despite macroeconomic challenges.

For the current fiscal year, ending in December, analysts expect ALGN’s EPS to grow 15.8% year over year to $8.12. The company’s earnings surprise history is dim. It exceeded the Wall Street estimates in one of the last four quarters while missing on three other occasions.

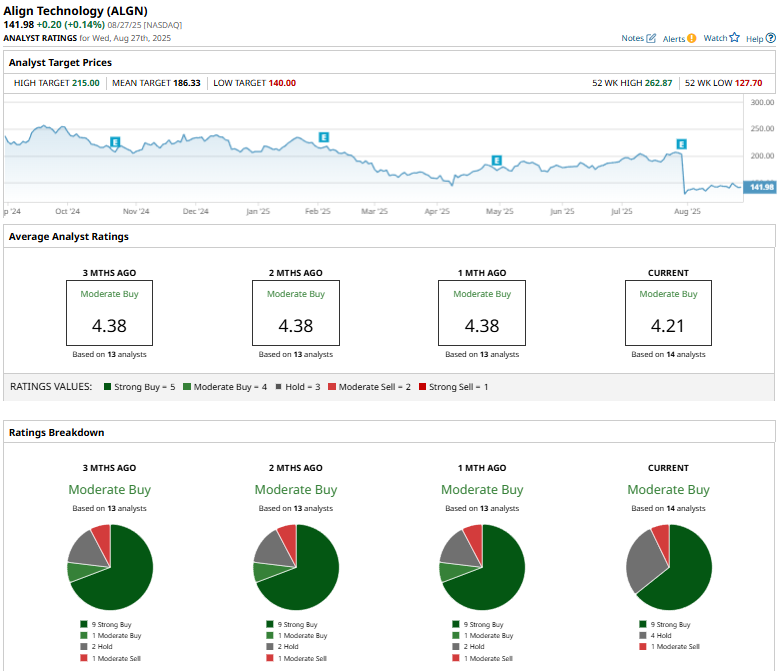

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on nine “Strong Buy,” four “Hold,” and one “Moderate Sell” rating.

On Jul. 16, Stifel reiterated its “Buy” rating and $275 price target on Align Technology.

The mean price target of $186.33 represents a 31.2% upside from Align Technology’s current price levels, while the Street-high price target of $215 suggests an upside potential of 51.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.