Should You Buy the Dip in Dollar Tree Stock?

Shares of discount retailer Dollar Tree (DLTR) have held up relatively well this year, despite many retailers struggling with tariffs and an uneven economy. The company’s bargain-focused model continues to draw cost-conscious shoppers, keeping its fundamentals intact. At the same time, a gradual shift away from the iconic $1 price point has helped the chain adapt to inflation and broaden its offerings.

This year, Dollar Tree also closed the chapter on Family Dollar, its long-troubled chain acquired in 2015, allowing it to focus entirely on its core Dollar Tree business. Investors largely applauded this move. But the smooth ride hit a bump after the firm reported second-quarter earnings on Sept. 3.

Even though sales and profits came in strong, management’s cautious profit forecast for the current quarter overshadowed the good news, knocking DLTR stock down more than 8% in a single day. So, with shares now trading 15% below the August high of $118.06, does this pullback represent only a temporary stumble? Or is it a signal for investors to tread more cautiously?

About Dollar Tree Stock

Virginia-based Dollar Tree stands as one of North America’s most prominent names in value retailing. Dollar Tree offers a diverse selection of everyday essentials as well as unexpected finds, including housewares, food, health products, toys, party supplies, seasonal items and more. The company has built its reputation on offering low-cost essentials alongside a “treasure-hunt” style shopping experience that keeps customers coming back.

Today, Dollar Tree operates more than 9,000 stores and 18 distribution centers across the U.S. and Canada, under the Dollar Tree and Dollar Tree Canada banners. The company’s market capitalization currently stands at about $21.3 billion. While DLTR stock has been under hot water after its latest earnings report, its longer-term price performance tells a very different story.

Shares of this discount retailer have proven resilient on Wall Street despite a choppy economic backdrop, with investors rewarding its steady performance. Over the past 52 weeks, the stock has surged an impressive 58%. So far this year, the momentum has been strong as well, with shares up 34% year-to-date (YTD).

For a better perspective, the S&P 500 Index ($SPX) has gained roughly 18% over the past year and 11% YTD, highlighting Dollar Tree’s ability to outpace the broader market.

Inside Dollar Tree’s Q2 Earnings Report

Despite the sharp selloff that followed its earnings release, Dollar Tree’s fiscal 2025 second-quarter report was packed with positives. Revenue for the quarter came in at $4.6 billion, a 12.3% year-over-year (YOY) increase and slightly ahead of Wall Street’s $4.5 billion estimate. Same-store sales climbed 6.5%, fueled by a 3% jump in customer traffic and a 3.4% rise in average ticket size — clear signs that both shopper volume and spending held firm.

Profitability was even more striking. Adjusted EPS landed at $0.77, up 13.2% from the prior year and close to double Wall Street’s expectation, beating estimates by a staggering margin. Management noted that approximately $0.20 of this benefit stemmed from the timing of inventory mark-on and tariffs, which provided an extra boost to the quarter's results.

Gross profit rose 12.9% to $1.6 billion, with gross margin expanding 20 basis points to 34.4%. The margin improvement was supported by better mark-on from pricing actions, lower domestic freight costs, reduced occupancy expenses driven by sales leverage, and a more favorable product mix. These operational efficiencies underscored management’s success in tightening the business while expanding the assortment.

Strategic moves also shaped the quarter. On July 5, Dollar Tree completed the sale of its struggling Family Dollar chain for roughly $800 million in cash proceeds, allowing the company to sharpen its focus on the flagship brand. At the same time, growth continued across the store base, with 106 new locations opened and approximately 585 stores converted to the company’s “3.0 multi-price format.”

Dollar Tree also highlighted that it has repurchased more than $1 billion of its own shares so far this year, reflecting confidence in its long-term outlook. Management attributed the strong quarter to sales momentum, margin outperformance, and market-share gains.

Looking ahead, the company raised its full-year fiscal 2025 net sales guidance to between $19.3 billion and $19.5 billion. Comparable-store sales are now expected to rise 4% to 6%. Adjusted EPS guidance was also lifted to between $5.32 and $5.72, reflecting expectations of sustained performance.

Still, not everything was met with applause. Management warned that higher tariff-related costs will weigh on Q3 earnings. Specifically, Dollar Tree expects adjusted profit to come in flat compared with last year’s $1.12 per share, partly because timing benefits recognized in Q2 will reverse in Q3. That cautionary outlook overshadowed otherwise strong results, triggering a negative reaction from investors.

What Do Analysts Think About Dollar Tree Stock?

While Dollar Tree’s latest results rattled investors, Truist Securities took a more upbeat view, raising its price target from $127 to $129 and reaffirming a “Buy” rating. The firm cited a stronger-than-expected Q2 performance, increased store-level investments, and a robust pace of share repurchases. Truist also emphasized that several one-time costs are expected to fade by 2026, giving analysts confidence to remain “aggressive buyers” on the recent dip.

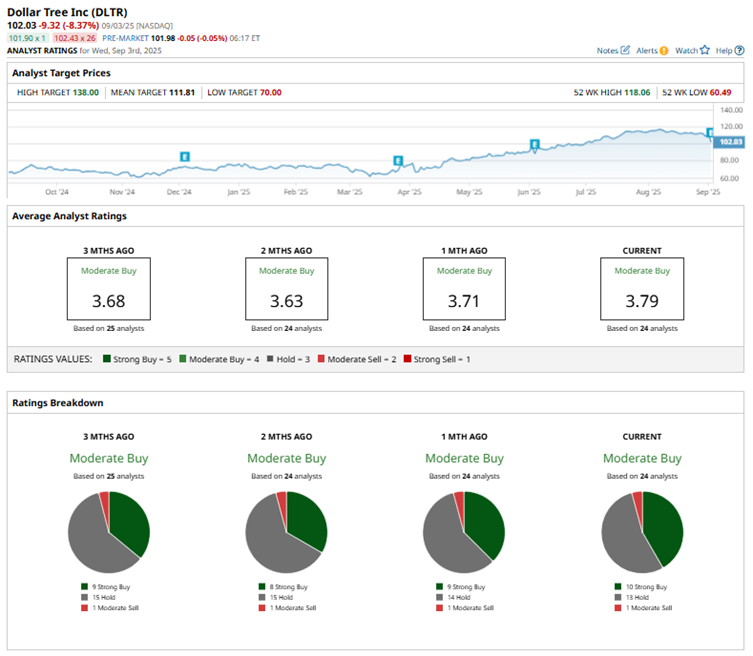

The broader analyst community also tilts bullish. Overall, Wall Street maintains a consensus rating of “Moderate Buy,” with 10 of 24 analysts calling for a “Strong Buy,” 13 advising to “Hold,” and just one suggesting a “Moderate Sell.

The average analyst price target of $111.81 indicates potential upside of 11.5% from current levels. Meanwhile, the Street-high target of $138 suggests that DLTR stock can rally as much as 38% from here.

Final Thoughts

While investors chose to zero in on Dollar Tree’s cautious Q3 outlook, the latest results highlighted strong fundamentals and steady growth. What's more, the recent selloff looks more like short-term noise and profit-taking than a sign of weakness. With analysts continuing to back DLTR stock and Dollar Tree refocusing on its core brand, the current pullback may well be setting up a compelling entry point for patient investors.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.