Is Frontier Group Stock a Buy, Sell, or Hold for September 2025?

One of the more impressive market movers last week is a company I really don't focus on too much. The ultra-low-cost carrier Frontier Airlines (ULCC), with a stock ticker to match its underlying business model (ultra-low-cost carrier), made a massive 15% move higher on Tuesday. For the week, shares of ULCC stock ended around 10% higher, so this move was mostly sustained and suggests the key catalyst driving this move remains a focal point for investors.

Let's dive into the key catalyst that investors are honing in on when it comes to Frontier and where investors see the company's future growth coming from.

Frontier Could Win Because Spirit Is Losing

In the realm of ultra-low-cost carriers, Frontier and other rivals such as Spirit Airlines (FLYYQ) are the key names most investors focus on, at least for the U.S. market.

News this past week that Spirit is undertaking its second bankruptcy in months has propelled some investors in the airline sector to consider Frontier as a clear market share winner as a result of this move. That's because as part of Spirit's second bankruptcy filing, the company noted plans to reduce the number of routes it provides to key markets, leading to the potential for monopoly-like market share in these areas.

In other words, Frontier may have a bit more wiggle room and pricing power to consider pushing prices slightly higher over time. Consumers may be willing to pay these nominally higher fares, given where many other large airlines' ticket prices currently come in at.

That's an important factor to consider, particularly when investors consider Frontier's current underlying fundamentals.

Higher Margins Could Boost ULCC Stock Big Time

I'm of the view that ultra-low-cost carriers are ultimately a good thing for consumers. They provide the lowest-cost option for travelers who may not otherwise have the budget to travel to certain locales while lowering prices across all major airlines that want to compete on certain routes.

However, this strategy of pinching pennies absolutely everywhere to deliver rock-bottom ticket prices to consumers can have its downsides. In a rising price environment (tariffs, trade-related concerns, and other factors have continued to drive inflationary forces), Frontier's input costs may continue to rise at a faster pace than the company can raise prices.

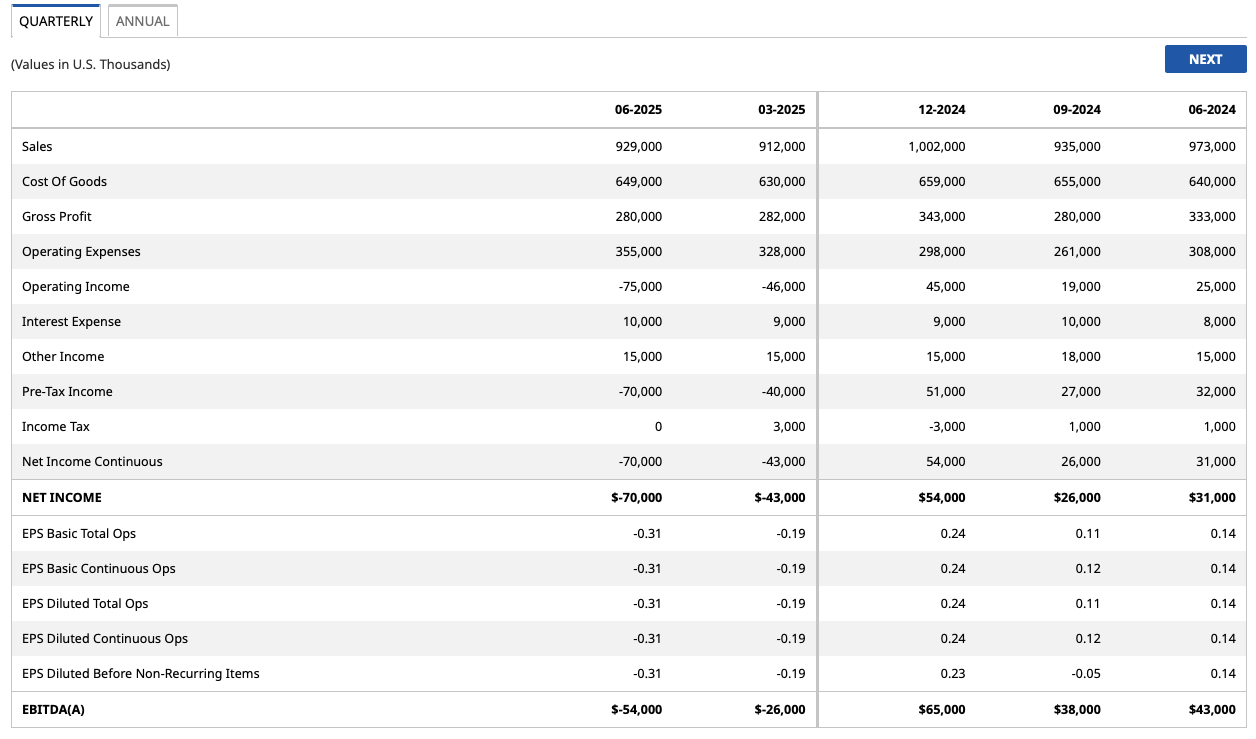

That appears to be the case in past quarters, as evidenced by the chart above. Frontier's EBITDA, probably the best metric to look at for investors trying to assess the underlying strength of an airline, has been trending in the wrong direction in recent quarters.

This trend, which does appear to be ingrained to some degree and at least partly attributable to tariffs and the macro environment, doesn't portend well for investors looking at a reason to consider this relatively cheap airline from a valuation perspective right now. However, if Frontier can dominate certain routes, Spirit will be forced to give up and raise prices to at least match where their input costs are, and we could be looking at a very different financial outlook over the near- to medium-term.

What Do the Analysts Think?

Now, I'm just one person looking at ULCC stock based on one piece of (positive) news (for Frontier at least) that has come through over the course of the past week. Most investors would, rightly I may add, place more credence in the words of Wall Street experts on the company.

Fair enough.

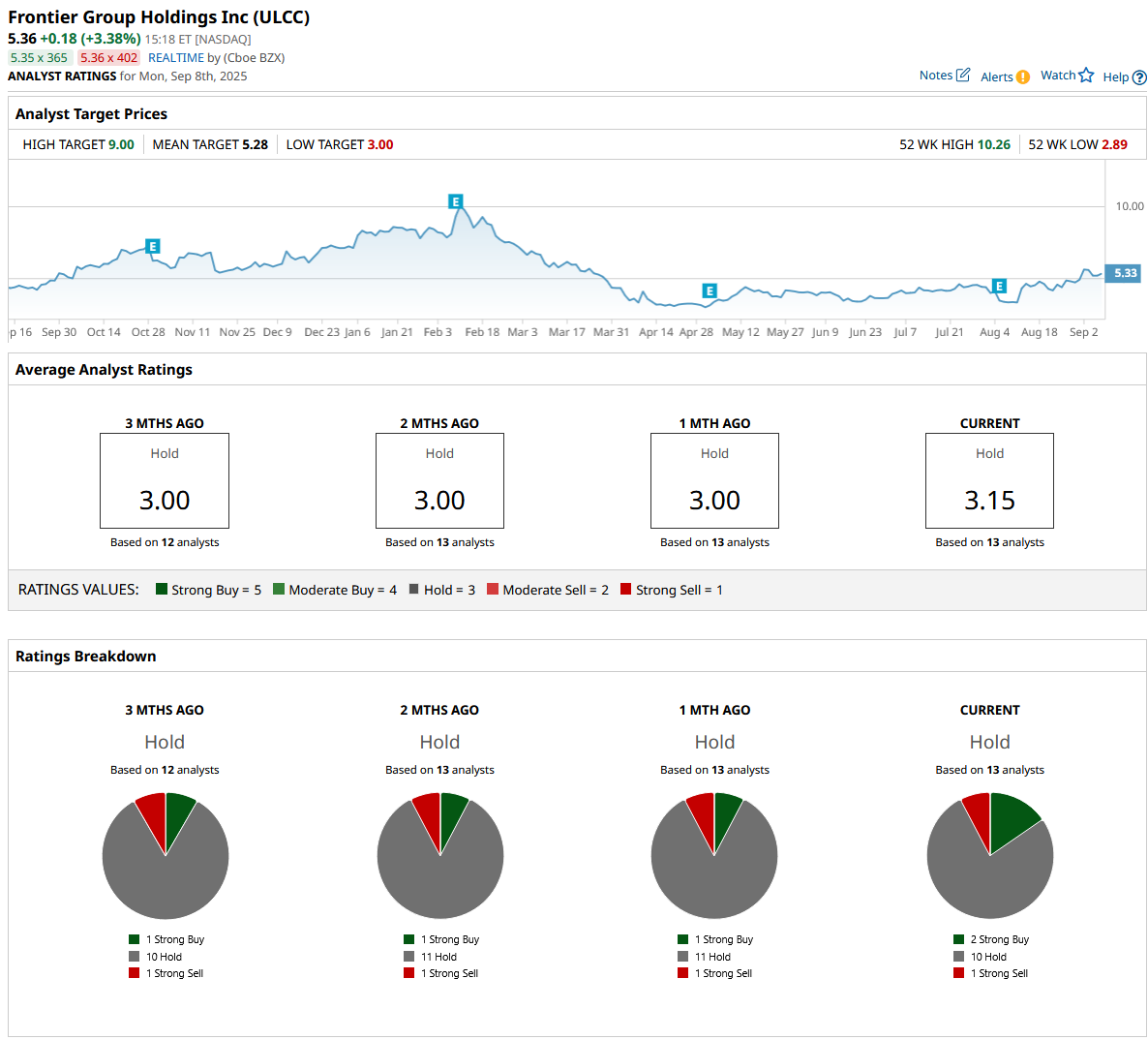

The consensus analyst price target for ULCC stock shown above, “Hold,” indicates that most Wall Street analysts think this stock is fairly valued presently. Now, many analysts may have to hustle to release their next notes on this stock, considering the recent high-profile catalyst that took ULCC stock higher over the past week likely isn't baked into their past models.

So, perhaps there is more upside in this name than what Wall Street is currently pricing in.

That said, I do think the current price target (about $5) on Frontier makes sense, considering the aforementioned fundamental trend the company has been on in recent quarters.

My view is simple: if Frontier can prove to investors the company's fundamentals are moving in a positive direction, this is a stock that's an easy buy here. But I'm personally going to be patient with this airline stock, simply because turnarounds can be much more painful and can take much longer than many investors think.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.