Dear Robinhood Stock Fans, Mark Your Calendars for September 22

/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

2025 has been a blockbuster year for Robinhood Markets (HOOD) and its investors. Shares of the retail trading platform have returned triple digits so far this year, riding a powerful wave of retail enthusiasm in meme stocks, cryptocurrencies, options, and mega-cap tech giants. Now, Robinhood is once again back in the spotlight after S&P Global announced that HOOD will officially join the prestigious S&P 500 Index ($SPX).

The news sent shares of HOOD stock soaring almost 15.8% on Sept. 8, marking the company’s biggest single-day jump since April and its third-strongest session over the past year. S&P Global confirmed that Robinhood will take the place of Caesars Entertainment (CZR) in the index, with the change set to go live before trading begins on Sept. 22. The long-anticipated move follows months of chatter across Wall Street about whether the company could secure a spot in the benchmark average.

With the much-awaited inclusion now just around the corner, here’s a fresh look at HOOD stock.

About Robinhood Stock

Founded in 2013, California-based Robinhood has reshaped the financial services landscape by pioneering commission-free stock trading and opening up market access to millions of everyday investors. Today, the company and its subsidiaries provide a wide range of tools, from trading stocks, options, futures, and crypto to retirement investing, premium features through Robinhood Gold, and professionally managed portfolios via Robinhood Strategies.

The no-commission trading app, which went public in 2021, now boasts a market capitalization of roughly $105.3 billion. After a rocky start following its market debut, Robinhood is now in the midst of one of its best years yet. A surge of interest in cryptocurrencies, supported by a more favorable regulatory climate, has played a key role in reviving profitability for the online broker. And its latest S&P inclusion news is a major milestone for the company.

HOOD stock’s performance has been nothing short of extraordinary. Over the past 52 weeks HOOD has skyrocketed an astounding 496%, dwarfing the S&P 500’s modest 19% return. The momentum has carried into 2025, with the stock up an explosive 215% year-to-date (YTD), easily outperforming the broader index’s 11% gain. Robinhood even set a new all-time high of $123.44 on Sept. 10.

Robinhood’s breakout rally this year has been hard to ignore, but it comes with a premium price tag. The stock is currently trading at a 75.7 times forward earnings, a staggering multiple compared to the sector median.

Robinhood’s Q2 Earnings Highlights

Robinhood’s fiscal 2025 second-quarter results, released on July 30, came in far stronger than Wall Street anticipated. Revenue climbed 45% year-over-year (YOY) to $989 million, comfortably topping estimates of $920.4 million. The surge was powered by transaction-based revenue, a proxy for trading activity, which jumped 65% YOY to $539 million, with cryptocurrencies, options, and equities all contributing to the momentum.

Cryptocurrency trading was the clear standout, with revenue nearly doubling to $160 million, up 98% from last year as digital asset activity reignited. Options generated $265 million, marking a 46% increase and underscoring rising demand for higher-margin derivatives. Equity trading also impressed, climbing 65% to $66 million. Together, these figures reflect how Robinhood continues to capture activity across multiple asset classes.

Strength extended beyond trading as well. Other revenues rose 33% to $93 million, fueled by the rapid adoption of Robinhood Gold. The Robinhood Gold subscription service, which offers higher cash sweep rates, larger instant deposits, and advanced research tools, has grown sharply, with memberships surging 76% YOY to 3.5 million. Profits were equally eye-catching, with EPS doubling to $0.42, beating expectations by a wide 36% margin.

On the platform side, funded accounts increased 10% YOY to 26.5 million, while total assets under custody nearly doubled, soaring 99% to $279 billion. The growth was fueled by strong net deposits, asset acquisitions, and higher valuations in both equities and crypto. Robinhood closed the quarter with $4.2 billion in cash and cash equivalents, underscoring its solid financial footing.

Why Robinhood Jumped on S&P 500 Inclusion News?

After months of speculation, Robinhood is finally getting the spotlight it has long awaited, and investors couldn’t be happier. The trading platform has often been seen by analysts and investors as a natural fit for the S&P 500, which is exactly why HOOD stock stumbled back in June when it failed to secure a spot in the last reshuffling.

The repeated exclusions from the S&P 500 had become a sore point for HOOD investors, particularly since rivals like Coinbase (COIN) and Block (XYZ) managed to secure spots earlier this year. But fast forward to today — with Robinhood officially set to join the index on Sept. 22 after a stellar performance so far this year — and the outlook for HOOD stock looks even brighter now.

Inclusion in the S&P 500 is more than a badge of honor. Investors rushed into HOOD stock on the news, knowing that index inclusion could unlock billions in trading activity. Once Robinhood is added, index-tracking funds and exchange-traded funds (ETFs) will be required to scoop up shares to mirror the benchmark, potentially fueling a wave of passive inflows. But the benefits don’t stop there.

Joining the index also signals a kind of institutional stamp of approval, a milestone that will help Robinhood shed its meme-stock image completely and step up to blue-chip status. With greater visibility, credibility, and investor confidence, Robinhood could find itself attracting more long-term capital, putting the company on even stronger footing for the years ahead.

What Do Analysts Expect for Robinhood Stock?

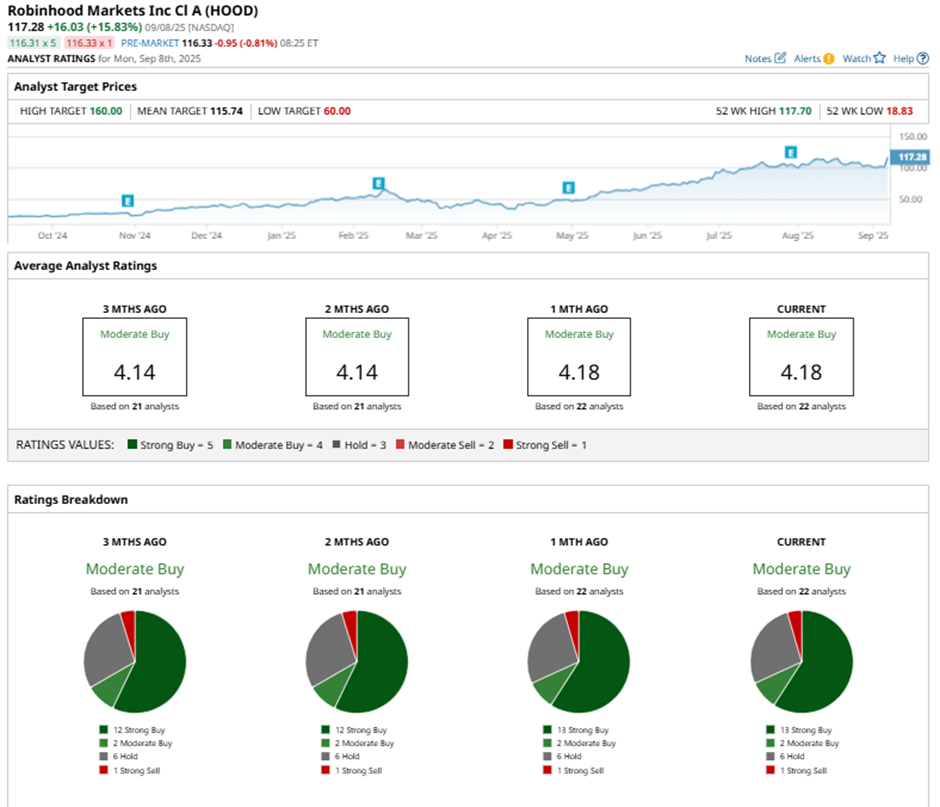

As Robinhood prepares to join the prestigious S&P 500 later this month, analysts are maintaining a positive stance with a consensus “Moderate Buy” rating overall. Of the 22 analysts offering recommendations, 13 advocate for a solid “Strong Buy,” two suggest a “Moderate Buy,” six play it safe with “Hold,” and the remaining one analyst gives a “Strong Sell" rating.

While HOOD stock’s explosive rally has already pushed shares beyond the average analyst price target of $115.74, optimism hasn’t faded. In fact, the most bullish forecast of $160 on Wall Street still points to 36% potential upside, a move that would send shares to fresh record highs.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.